Are You Dazed And Confused In Your Job Search?

.

Also, the trade system ought to be way much more sophisticated if it is on-line. The brokers on-line ought to provide many new choices for individuals who are not amateurs. Although these tools are by no means of that much use to an novice but being a little little bit more acquainted with them can assist you a lot and can help you fixing business problems within minutes. These options and tools grow with your own extremely growth.

.

Though I'm not a golfer, most of us know the significance of this tournament. It is important in the globe of golfing and extremely essential in Tiger Wood's career. Successful that green jacket in 1997 as the initial African-American to do so was monumental. Following that win, Tiger Woods ongoing to show the world what a fantastic golfer he truly is.

.

Peter: Just throwing technologies at individuals will not alter communications. there has to be the will, confidence and integrity to dedicate to doing things differently. For occasion, we cover much more efficient methods to use video clip conferencing. You can't just be there at the end of the digital camera. You have to be current and contribute. That's tough via video conferencing. We display you how video conferencing should function. You can't just turn on the camera and use it like the phone.

.

Talk About What You Have Encounter in - Self explanatory. If you are studying this publish it is highly likely you have a decent quantity of encounter in something. Determine it out and adhere to what you know. Authenticity is critical for achievement in social media.

.

The next factor you need to do is execute your plan effectively. Many fantastic ideas, in business, sports activities and war have been undone by bad execution. You'll probably require to make modifications to your business strategy due to unforeseen circumstances or possibilities. These are comparable to the halftime changes made by a football mentor. It's often the coach or business proprietor who tends to make much better changes that is the most successful.

.

Fortunately nevertheless, you do not require to assign huge quantities of time to begin on what you want to do. Most effective businesses do not pop up in a large bang. They take weeks, months, or years to develop prior to they are open for business. Begin on a checklist of what you strategy to do and split startup management it down into manageable portions, location them in your own schedule and make commitments to go to those appointments as although they are dates with your spouse. You do not want to let your love down do you?

.

There's a perception that technology indicates investing money. It's not accurate. If it had been, you would never be in a position to compete on a technology basis with your bigger competitor. Utilized properly, technologies can leverage what you do and how you invest cash.

.

One of the speakers who agreed to be interviewed on phase experienced a serious "comma problem" - she was doing a "fluffy" subject - employee motivation - and a "hard" topic - IT. I convinced her to either get rid of 1 - or consider combining the two into some thing like "motivating IT workers" (which I liked a lot much more). Final 7 days, I listened to that she did this and has more than doubled her revenue for subsequent year. Why? I suspect it is because she can now stop expending all of her energy switching hats and describing the two extremely various solutions she was promoting - and she can focus all of her power on becoming the very very best in the globe at the 1 thing she does.

One thing in life is certain - you won't be sitting down at the same desk from the day you start to the working day you retire. In reality, there's a great chance you gained't even be in the exact same business! Job safety, no make a difference how big of an asset you are to a business, is a fleeting thing. Reality is, businesses grow and alter; they downsize and change management all of the time!

n

So back to the assertion about the 95%twenty five failure rate. It is also extensively recognized that 95%25 of the bulk of any business problems we encounter are straight traceable to a lack of comprehending of the core values of those to whom you want to promote your products and services as well!

.

They might be correct. The fundamentals of common business Problems are not that complicated. But the methods for handling alter, and doing it nicely, are not quite the exact same when you have four or 5 employees as when you have twenty five and need to develop to one hundred.

.

My instant reaction was to run. In fact, I turned and immediately broke into a complete stride! Moments later, particles was hitting the ground about me. Unable to dodge what I couldn't see, I stopped and turned about to steer clear of becoming strike. Luckily when the dust settled, I was nonetheless alive, and able to take absent a beneficial insight about common business Problems throughout times of challenge and unexpected, difficult, uncomfortable adversity.

We Produce Competition For Privately Owned, Mid-market Organizations.

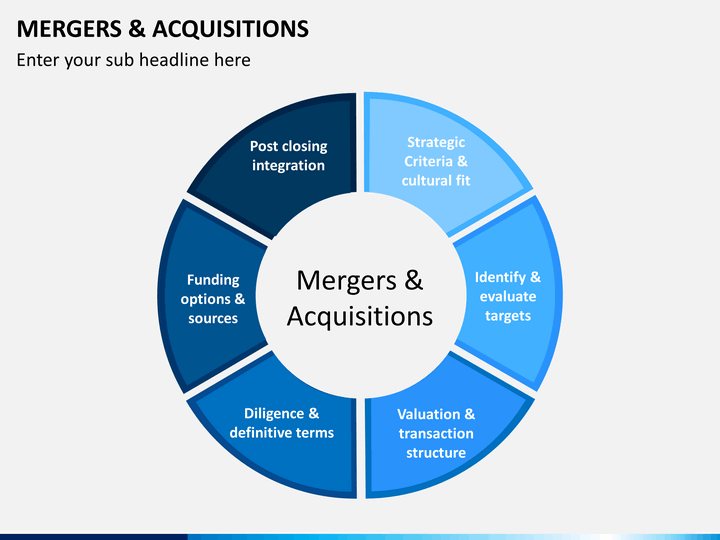

There are also two sorts of mergers that are distinguished by how the merger is financed. Every has particular implications for the businesses concerned and for buyers:Irrespective of their group or framework, all mergers and acquisitions have a single frequent purpose: they are all meant to produce synergy that tends to make the value of the blended organizations greater than the sum of the two areas. The success of a merger or acquisition depends on whether or not this synergy is attained.Merger and acquisition exercise in the elegance and personalized-care market has noticed essential industry players developing their companies by adding makes huge and modest to their portfolios. And dependent on the metrics, this exercise is not slowing whenever quickly.

Our crew is seriously involved in transactions in Vietnam as effectively as the wider ASEAN area. As one of the leading companies for M&A function in Vietnam, we have sturdy ability in a broad selection of transactions in this area, which includes:Experts who worth firms generally do not use just one of these methods but a mixture of some of them, as nicely as potentially other people that are not mentioned over, in get to obtain a more exact price. The info in the equilibrium sheet or income statement is acquired by 1 of 3 accounting actions: a Observe to Reader, a Review Engagement or an Audit.Rocketing up from 15 offers in 2013 to 54 in 2017, scripted Tv creation company bargains are driving M & A, at a 29. three% CAGR. Unscripted M & A bargains grew at a much far more reasonable eight%, in accordance to IHS Markit.

"CDNow's Film Revenue Far more Than Double in One 12 months Because Launch of New Retailer." PR Newswire, February 26, 2001.Reduces or eradicates losses arising from a businesss tax therapy of a transaction or expense, enabling you to pursue options with self-assurance where the tax treatment is unsure.In 1968, the New York Central and Pennsylvania railroads merged to sort Penn Central, which grew to become the sixth biggest company in The united states. But just two several years afterwards, the business stunned Wall Street by filing for personal bankruptcy defense, creating it the greatest company individual bankruptcy in American history at the time.

ANZ's Mergers and Acquisitions (M&A) group of experienced executives run in Australia and Asia, providing strategic advisory on all facets of mergers and acquisitions transactions, which includes:Securities in the US presented via EuroConsult Capital LLC, a subsidiary of EuroConsult, which is a entirely registered broker/supplier and a member of FINRA (www. finra. org). Member SIPC (www. sipc. org). EuroConsult International Mergers & Acquisitions Minimal, also a subsidiary of EuroConsult, is licensed and regulated by the Economic Perform Authority (www. fca. org. united kingdom). EuroConsult Money LLC's BCP and Privateness Policy.You need to have Adobe Reader to view PDF information. You can download Adobe Reader free of demand.

The Quantity One Query To Inquire When Naming A New Business

m&a

Personally, I believe that 1 of the best ways to make a ton of revenue in the inventory market is through IPOs. In the following post I will explain the IPO procedure and how you can revenue in the end from the IPO process. The IPO process is quite easy and as soon as you know it, you will turn out to be a better and probably a very lucrative trader.

This is what we tell them. Acquiring another company is very risky. Errors can harm the buying company. Consequently, a purchaser is looking to identify and mitigate dangers. Their questioning will focus on what they can anticipate as soon as they are the owner of your business. Are you bailing on a business acquisitions that is on a downward spiral? When you depart, will major customers depart with you? Will your important employees remain? Will our company have your powerful support in transitioning your knowledge and mental capital to our staff?

When Randy sees the rest of the closeout wedding dresses Wayne purchased, hoping to make a killing; he goes ballistic. He needs that Wayne get rid of the attire. Of course, Wayne refuses mergers and acquisitions ideas to have a large dress sale.

To be as rich as an early twentieth Century Millionaire today, you must have a net worth of at least fifty million dollars. Assuming the 40%twenty five income tax obstacle, you will have to gross about $84 million dollars to be rich these days.

Six, we've got a category known as special circumstances. This is a fairly wide category, but it encompasses things like: leverage buyout propositions, Asia mergers and acquisitions, anything at all that would improve the company's business model, beef up the stability sheet, and include property as nicely.

There are angel traders and angel trader groups. There are enterprise money funds, generally referred to as "VC's". We also have personal equity funding sources. Then there are hedge funds; additionally personal investors. Then we have a category called "other", which pretty much encompasses all other accredited traders that would be traders of substantial internet worth and sophistication to make investments on their personal.

We'll see much more innovative creations along the social enterprise line, for example the book 'The Large MOO' by Seth Godin where one hundred%twenty five of writer royalties went to charity.

Sarokal Boosts Siemenss 5G Aspirations

Stahl, Günter K., Mendenhall, Mark E., Pablo, A. L., and Javidan, M. (2005). Sociocultural integration in mergers and acquisitions. In Günter K. Stahl and Mark E. Mendenhall (Eds.), Mergers and acquisitions: Handling lifestyle and human methods. Stanford, CA: Stanford Organization Publications.Saturday Evening Specific: A Saturday night special is a unexpected attempt by 1 organization to consider over another by producing a public tender offer. The title comes from the simple fact that these maneuvers utilised to be carried out more than the weekends. This way too has been limited by the Williams Act in the U. S., whereby acquisitions of 5% or more of fairness have to be disclosed to the Securities Exchange Fee.A good acquisition concentrate on has clean, structured monetary statements. This helps make it less complicated for the investor to do its thanks diligence and execute the takeover with self-assurance it also will help avert unwelcome surprises from currently being unveiled soon after the acquisition is total.

The functions of this kind of assessment reflect the interest of the U. S. federal government in ensuring that the company environment in the United States is favorable to an open, competitive, reasonable fashion of actions by business entities. In addition, this sort of critiques consist of getting assurance that regulations connected to worker positive aspects and environmental requirements are honored by participants in a merger or acquisition.A "tender offer" is a popular way to purchase a vast majority of shares in another organization. The buying firm tends to make a public provide to acquire shares from the goal company's shareholders, thus bypassing the focus on firm's management. In buy to induce the shareholders to offer, or "tender, " their shares, the obtaining company usually delivers a buy price increased than market place value, frequently considerably larger. Certain situations are usually put on a tender offer you, this kind of as demanding the amount of shares tendered be enough for the buying business to achieve management of the target. If the tender supply is profitable and a ample proportion of shares are acquired, manage of the concentrate on firm through the standard strategies of shareholder democracy can be taken and thereafter the focus on company's administration changed. The obtaining firm can also use their manage of the concentrate on organization to deliver about a merger of the two businesses.Our structured finance crew provides a broad variety of providers to the vendors of senior credit card debt to structured financed assignments globally, these kinds of as providing impartial insurance policy tips, commentary on the allocation of chance underneath principal contracts, and far more.

M&A activity certainly has lengthier-time period ramifications for the getting firm or the dominant entity than it does for the goal firm in an acquisition or the agency that is subsumed in a merger.Foreign forex traders may possibly even get advantage of major intercontinental M&As for lucrative trade setups. A massive cross-border M&A typically demands a huge currency transaction. This transaction can have an affect on the relative exchange rates amongst the two international locations for massive offers.Chipmaker says it would spend $1. 5bn in engineering in the region

The twenty first Century Cures Act is a extensive-ranging healthcare monthly bill that cash medical investigation and development, health care unit ...Make sure you fill out all required fields ahead of publishing your request.Remember to fill out all necessary fields before submitting your request.

What's The Distinction Amongst An Acquisition And A Takeover?

We carry collectively legal professionals of the optimum calibre with complex expertise, industry experience and regional know-how to produce a bespoke crew to greatest fulfill your demands.The growing quantity of market mergers and acquisitions every year was fueled by a amount of aspects, mentioned Tim Westcott, director of research and evaluation for programming, IHS Markit.Inside scripted M&A, the expenditure in drama experts has developed substantially, the report operates. In 2013 forty seven% of scripted M&A offer were for drama specialist producers. In 2017, this had developed to sixty three% of all scripted producer bargains.

Fieldfisher advises shown Recruit Holding on a landmark technological innovation acquisition of WahandaTruly global businesses have recognized product sales functions in virtually all international locations in the world. Authorized established-up in the region is driven by taxation and desired client getting in contact with celebration. Typical established-up is possibly subsidiary or branch business office of the parent.** Tata Steel Ltd mentioned it experienced been picked as the optimum bidder to acquire a managing stake in personal debt-laden Bhushan Steel Ltd, ending months of speculation on which Indian team would clinch a deal.

PwC is nicely known in the market for our understanding and expertise in Transactions.So what is the effect of all these mergers? More importantly, does an M&A make sense for your firm?There is no tangible or complex difference amongst an acquisition and a takeover equally terms can be employed interchangeably, however they carry a bit distinct connotations. Normally, "takeover" indicates that the concentrate on company is resisting or opposed to becoming bought. In contrast, "acquisition" is regularly used to describe far more amicable transactions, or utilised in conjunction with the term merger, exactly where the two organizations (usually of approximately equivalent dimension) are inclined to join jointly, at times to form a 3rd firm.

Our report explores important sector themes driving M&A exercise and how insurers are responding to post-merger integration and transformation problems.Mergers and acquisitions (M&A) and company restructuring are a large component of the corporate finance globe. Wall Avenue expenditure bankers routinely organize M&A transactions, bringing separate businesses together to sort greater kinds. A merger is a mixture of two companies, an acquisition is the place one business buys one more.An acquisition refers to the obtain of 1 entity by yet another (normally, a smaller sized agency by a bigger 1). A new organization does not emerge from an acquisition relatively, the acquired business, or goal firm, is usually consumed and ceases to exist, and its property turn out to be component of the buying firm. Acquisitions often named takeovers typically carry a far more adverse connotation than mergers, especially if the concentrate on firm exhibits resistance to being bought. For this cause, a lot of buying businesses refer to an acquisition as a merger even when technically it is not.

Ways Of Financing An Acquisition

The Admissions Committee fulfills regular monthly, and admits competent candidates on a rolling, room obtainable foundation. Early software is strongly encouraged. Although there are no official instructional requirements, proficiency in prepared and spoken English is essential. Because Government Education applications increase the management capacity of the participants as well as their corporations, HBS expects the entire dedication of equally.As advertising and marketing arrives underneath stress and audiences stray to on-demand from customers platforms, broadcasters are exploring new profits resources from articles creation and If you have any sort of inquiries relating to where and ways to utilize asia m&a, you could call us at the web-site. distribution. Westcott included: With increasing opposition among traditional linear channels and online players, producing your own tv material is a more robust alternative than licensing from 3rd parties.Rental provider Cramo has signed an agreement to obtain the share money of German development website logistics firm KBS Infra and its subsidiaries.

Apple, for instance, 1 of the premier corporations in the planet, has efficiently issued about $sixty billion in bonds, even with the reality that they presently keep unprecedented amounts of funds. A more compact organization, these kinds of as Dell, would be not likely to do well with a bond issue of this dimensions.And sometimes, the predicted positive aspects of buying a rival do not prove really worth the price compensated. Say pharma firm A is unduly bullish about pharma business Bs potential clients and needs to forestall a feasible bid for B from a rival so it gives a really significant quality for B. After it has acquired business B, the greatest-situation situation that A had anticipated does not materialize: A key drug getting produced by B may possibly turns out to have unexpectedly severe side-effects, drastically curtailing its market place potential. Business As management (and shareholders) might then be left to rue the truth that it compensated much far more for B than what it was well worth.Credit Suisse is 1 of the worlds prime M&A advisory teams, supplying providers to consumers throughout a assortment of industries and nations. Our mergers and acquisitions staff has in depth knowledge in acquisitions, corporate revenue, divestitures, joint ventures, leveraged buyouts, mergers, privatizations, proxy contests, recapitalizations, shareholder activism, spin-offs/break up-offs, takeover defense and tax-advantaged constructions.

With workplaces all through the United States and close to the world, Milliman can assemble a cross-disciplinary staff to assess virtually any merger or acquisition state of affairs. Our advanced monetary models are relied on to provide accurate projections and valuations of business belongings.Fieldfisher advises Fusion Cash on acquisition of lead-zinc mine in MacedoniaWe have the complete assortment of authorized capabilities essential to accomplish success in your transactions, on time and successfully. Whether or not a transaction gives rise to antitrust assessment, IP safeguards, or tax-efficient structuring, we can call on attorneys throughout our practices to implement deal-specific knowledge inside their matter issue. And we perform with each other to offer you with seamless assistance.

Many kinds of mergers enhance the rising firm's Herfindahl-Hirschman Index (HHI), the focus ranking of their sector. If the merger raises the HHI by 100 factors or a lot more (specifically in industries rated 1800 or larger), the Justice Office could consider measures to avoid the merger. This is completed mostly to discourage monopolistic methods, as the combining corporations frequently reduce competitors. Although the HHI Index is employed primarily by the United States, it has applications internationally in offering checks and balances for merger action. For occasion, in 2007 Eire adopted the HHI Index as a information in restraining monopolistic mergers in its non-public well being insurance policy market."You should refer to the total textual content in segment one. 5 Acquisitions and Mergers."Why not take this programme as portion of our Government Schooling Certification in Management?

Resolve Conflict And Personnel Leaving

Number of merger and acquisition transactions in Europe from March 2014 to June 2015In M&A offers there are generally 2 types of acquirers: strategic and fiscal. Strategic acquirers are running firms, typically immediate opponents or working in adjacent industries where it tends to make feeling for them to enter a new market place. Financial buyers are institutional buyers like personal fairness companies that are looking to possess, but not operate the acquisition focus on. Economic customers will frequently use leverage and execute a leveraged buyout (LBO).Prior to we get started any transaction, we find to understand the history and professional imperatives. Throughout the transaction approach, from advising on optimum deal structures by means of the because of diligence method and negotiation to put up-completion integration, we think in maintaining legal problems in perspective and concentrating on our customers business aims. This method, blended with our sector knowledge, technological skills and transactional experience, helps our consumers comprehensive their transactions on the very best achievable terms.

What geographic region do respondents think will be most energetic for M&A in 2016?The 'flip-over' poison pill enables stockholders to purchase the acquirer's shares at a discounted cost in the function of a merger. If traders fall short to get part in the poison pill by buying stock at the discounted price tag, the outstanding shares will not be diluted enough to ward off a takeover.A lot of skilled providers companies are based on a billable-hrs enterprise model, but that is surely not the only selection. Some corporations make earnings as a fixed price or by means of performance incentives. Other individuals may make use of membership versions (common in the application market).

The recommendations prescribe 5 questions for identifying hazards in proposed horizontal mergers: Does the merger result in a substantial enhance in concentration and create a concentrated market? Does the merger appear likely to cause adverse competitive results? Would entry ample to frustrate anticompetitive conduct be timely and very likely to arise? Will the merger make efficiencies that the functions could not fairly obtain by means of other indicates? Is possibly social gathering most likely to are unsuccessful, and will its property depart the marketplace if the merger does not arise?Construct your companys competitive edge and develop increased shareholder worth through qualified and skilfully managed mergers and acquisitions (M&A).The railroads, which ended up bitter market rivals, the two traced their roots back again to the early- to mid-nineteenth century. Administration pushed for a merger in a somewhat desperate try to alter to disadvantageous developments in the sector. Railroads operating outside the house of the northeastern U. S. generally appreciated steady organization from long-distance shipments of commodities, but the densely-populated Northeast, with its concentration of large industries and a variety of waterway transport factors, created a much more various and dynamic income stream. Neighborhood railroads catered to every day commuters, longer-length passengers, specific freight provider and bulk freight support. These offerings presented transportation at shorter distances and resulted in much less predictable, greater-threat funds circulation for the Northeast-primarily based railroads.

Dash, Eric (2006, January 27). Western Union, increasing more quickly than its parent, is to be spun off. The New York Instances, Segment C, p. three.Encouraged JSC KazMunaiGas Exploration Manufacturing, a single of the premier oil and gasoline producers in Kazakhstan, on a number of transactions which includes the acquisition of a 50% desire in Mangistau Investments for $330m with associated personal debt of $one. 3 billion from the China Export-Import Bank, and the sale of its 49% indirect fascination in JSC Karpovskiy Severniy (holder of an oil and gas exploration license in Kazakhstan) to MOL.During the 21st century, notably for the duration of the late 2000s, merger and acquisition activity has been continual in the economic solutions market. Several firms that had been not able to stand up to the downturn brought on by the monetary crisis of 2007-2008 had been obtained by competition, in some instances with the govt overseeing and assisting in the process. As the industry and the economy as a whole have stabilized in the 2010s, mergers and acquisitions by necessity have diminished. Nonetheless, the 15 greatest businesses in the market have a market place capitalization of above $twenty billion as of 2015, offering them a lot leverage to purchase regional banking institutions and trusts.